Parametric insurance to build financial resilience

On October 4th, 2024, Generali Global Corporate & Commercial and the United Nations Development Programme Insurance and Risk Finance Facility (IRFF) launched a joint paper that explains how parametric insurance can support the financial resilience of the most vulnerable communities around the world. The aim of this work is to create a roadmap for organizations and governments interested in adopting this type of policy as part of their sustainability efforts and looking for ways to measure its impact.

How communities can use parametric insurance to speed up recovery

Insurance acts as a financial shock absorber. However, between 2010 and 2020, only 33% of natural catastrophe losses were insured on average (GFIA, 2023). This leaves governments, businesses and families struggling with huge costs, economic hardship, and slow recovery.

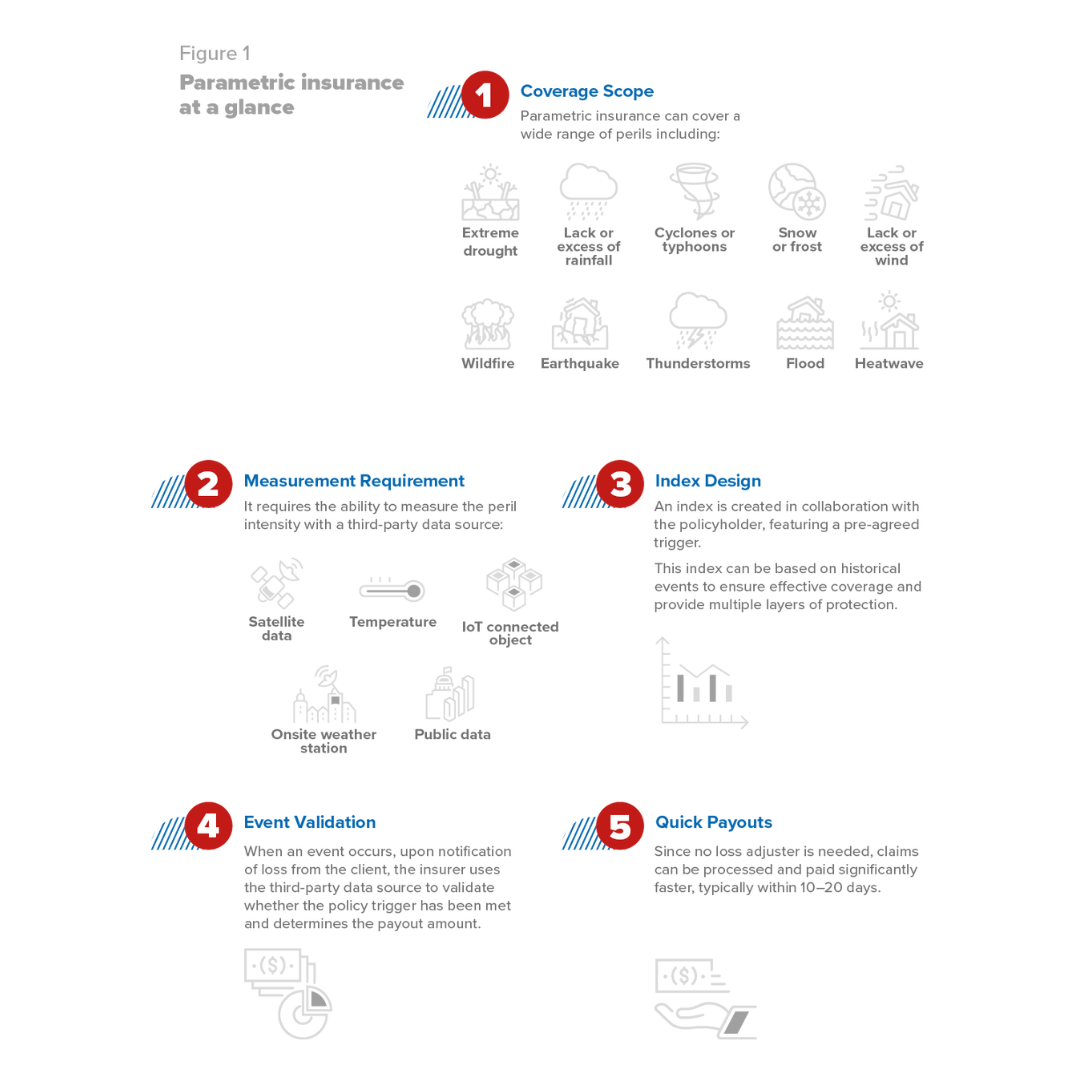

An innovative type of insurance policy is emerging as a sustainability tool that makes it easier for communities to get back on their feet more quickly: parametric insurance.

As governments and companies work to cope with the environmental and social consequences of climate change, it is equally important to immediately improve the financial resilience of communities hit by catastrophic natural events or other perils. This is especially crucial for the most remote and vulnerable communities, which often suffer the most but are harder to reach with traditional insurance. However, with the advent of parametric insurance, these communities may now begin to access financial protection.

Parametric insurance for sustainable development

With scalable and rapid payouts, parametric insurance allows for quick recovery from measurable climate-related events like hurricanes, floods, and natural disasters such as earthquakes. Its simplicity and speed can be a game changer, especially for vulnerable communities. By providing the funds they need immediately to help them recover sooner, parametric insurance can become a tool for sustainability and resilience.

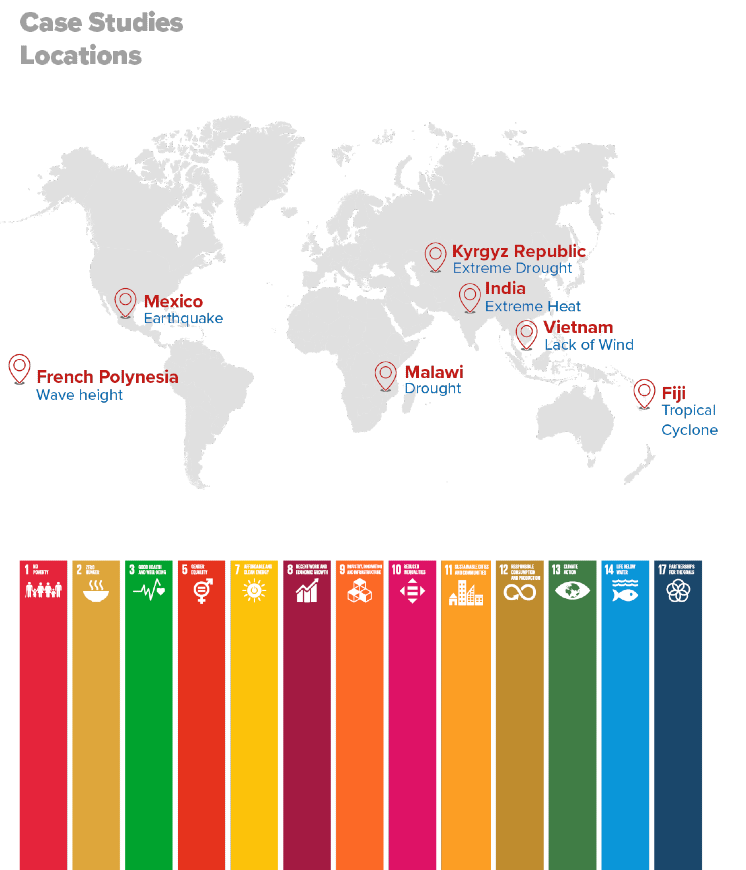

Real-life examples of how parametric insurance builds resilience

- A drought in Malawi, where 80% of the population – of which 59% is female -- works in agriculture, creating food insecurity.

- An earthquake in Mexico, where only 22% of $5.8 billion in the 2017 earthquake losses were covered by insurance, imperiling the social services safety net of a country where 36% of the population lived in poverty in 2022.

- With climate change, stronger and more recurrent extreme heat waves are risking the livelihoods and health of people in India, particularly within the informal economy, where 90% of women in India’s labor force work.

These are a few of the seven real life case studies highlighted in a report by Generali and the United Nations Development Programme looking at the risks covered by parametric insurance and how it works. Read all of them in the full paper available below.