Generali Group Consolidated Results At 31 December 2022(1)

14 March 2023

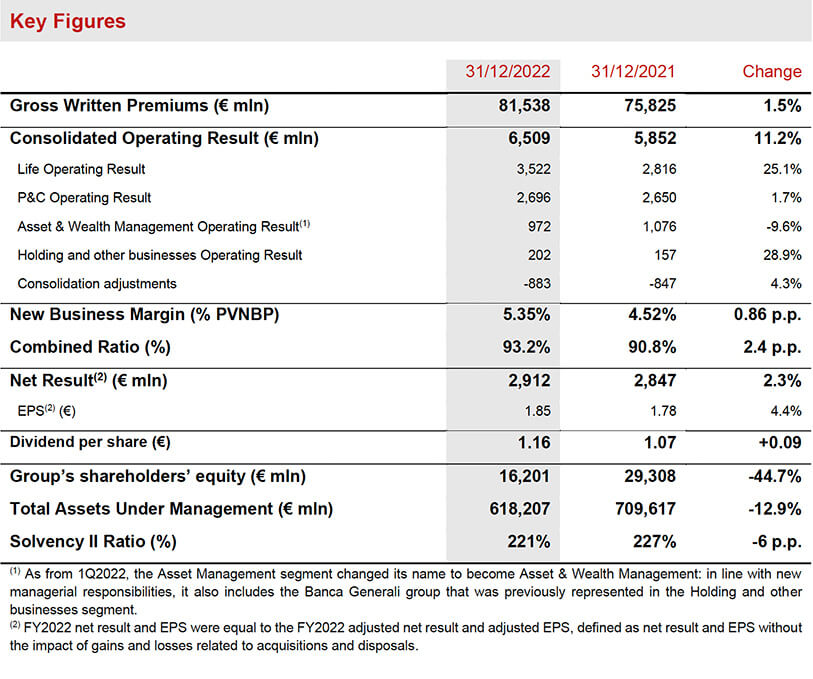

Generali achieves its best ever operating result with continued growth in premiums and net result. Extremely solid capital position

- Gross written premiums of € 81.5 billion (+1.5%), with strong P&C growth (+9.8%), led by non-motor. Resilient Life net inflows of € 8.7 billion, entirely focused on unit-linked and protection, consistent with the Group strategy

- Record operating result at € 6.5 billion (+11.2%), mainly driven by Life, together with P&C growth. The Combined Ratio was 93.2% (+2.4 p.p.). New Business Margin was excellent at 5.35% (+0.86 p.p.)

- Net result grew to € 2,912 million (+2.3%)2

- Extremely solid capital position, with the Solvency Ratio at 221% (227% FY2021)

- The proposed dividend per share of € 1.16 (+8.4%) confirms the Group’s focus on shareholder returns

Generali Group CEO, Philippe Donnet, said: “Generali’s results confirm the success of our transformation journey, which continues through the disciplined and effective implementation of the 'Lifetime Partner 24: Driving Growth' strategy. Powered by a clear vision to position the Group as a global leader in insurance and asset management, we are on track to achieve the targets and ambitions of our strategic plan, delivering sustainable growth to create value for all our stakeholders, even in a challenging geopolitical and economic context. This has enabled us to propose to our shareholders, once again, an increased dividend, thanks to continued earnings growth and the Group’s strong cash and capital position. Generali also continues to lead the way in sustainability, now fully integrated within all the Group’s business activities in line with our commitment to act as a responsible insurer, investor, employer and corporate citizen. We have achieved all of this thanks to the passion of our people and our unique agent network.”

Executive summary

Milan - At a meeting chaired by Andrea Sironi, the Assicurazioni Generali Board of Directors approved the consolidated financial statements and the Parent Company’s draft financial statements for the year 2022.

Gross written premiums rose to € 81,538 million (+1.5%), thanks to the positive performance of the P&C segment, led by the non-motor line.

Life net inflows were € 8.7 billion (-36.1%). The unit-linked line and the protection line recorded € 8.9 billion and € 5.0 billion of net inflows, respectively. The savings line recorded net outflows of € 5.2 billion.

Life technical provisions amounted to € 414.7 billion (-2.3%), mainly reflecting the contraction in the unit-linked line, due to volatility in financial markets.

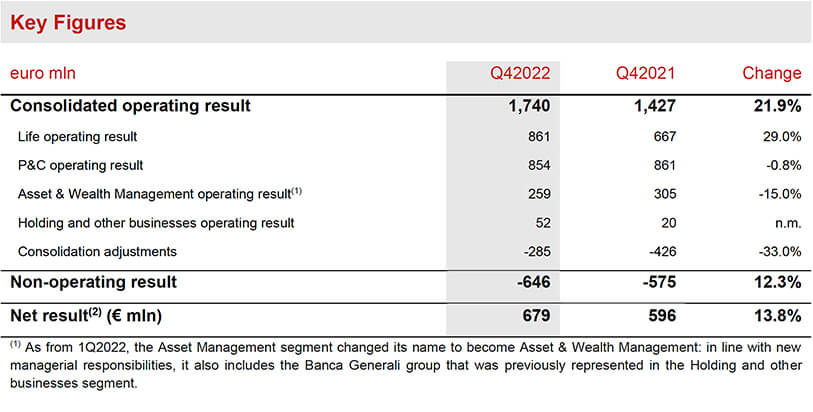

The operating result grew to € 6.5 billion (+11.2%), thanks to positive growth in the Life, P&C, and Holding and other businesses segments.

The operating result of the Life segment grew strongly, reaching € 3,522 million (+25.1%), reflecting excellent technical profitability, which was also confirmed by the New Business Margin at 5.35% (+0.86 p.p.).

The operating result of the P&C segment also increased, reaching € 2,696 million (+1.7%). The Combined Ratio stood at 93.2% (+2.4 p.p.), mirroring the evolution of the loss ratio, which also reflected the impact of hyperinflation in Argentina. Excluding this country, the Combined Ratio would have been 92.6% (90.4% FY2021).

The operating result of the Asset & Wealth Management segment was € 972 million (-9.6%). Banca Generali group's operating result amounted to € 334 million (-17.4%) and was affected by the performance of financial markets, impacting performance fees. The operating result of Asset Management was € 638 million (-5.0%), due to the reduction in assets under management (AUM), primarily driven by market effect.

The operating result of the Holding and other businesses segment increased to reach € 202 million (€ 157 million FY2021), supported by the contribution of the real estate business.

The non-operating result was € -1,710 million (€ -1,306 million FY2021) which reflected, in particular: € -511 million in impairments on investments classified as available for sale (€ -251 million FY2021), including Russian investments3; € 71 million in net realised gains compared to € 368 million in FY2021, when the Group benefitted from two real estate transactions4; and other net non-operating expenses, including € -195 million of restructuring expenses (€ -387 million FY2021, which reflected the extraordinary costs related to the integration of the Cattolica group for € -212 million).

The net result grew to € 2,912 million (+2.3%), mainly thanks to the positive performance of the operating result driven by the Life, P&C, and Holding and other businesses segments. Excluding the impact of Russian impairments, the net result would have been € 3,066 million (+7.7%)5.

The Group's Total Assets Under Management were € 618 billion (-12.9%).

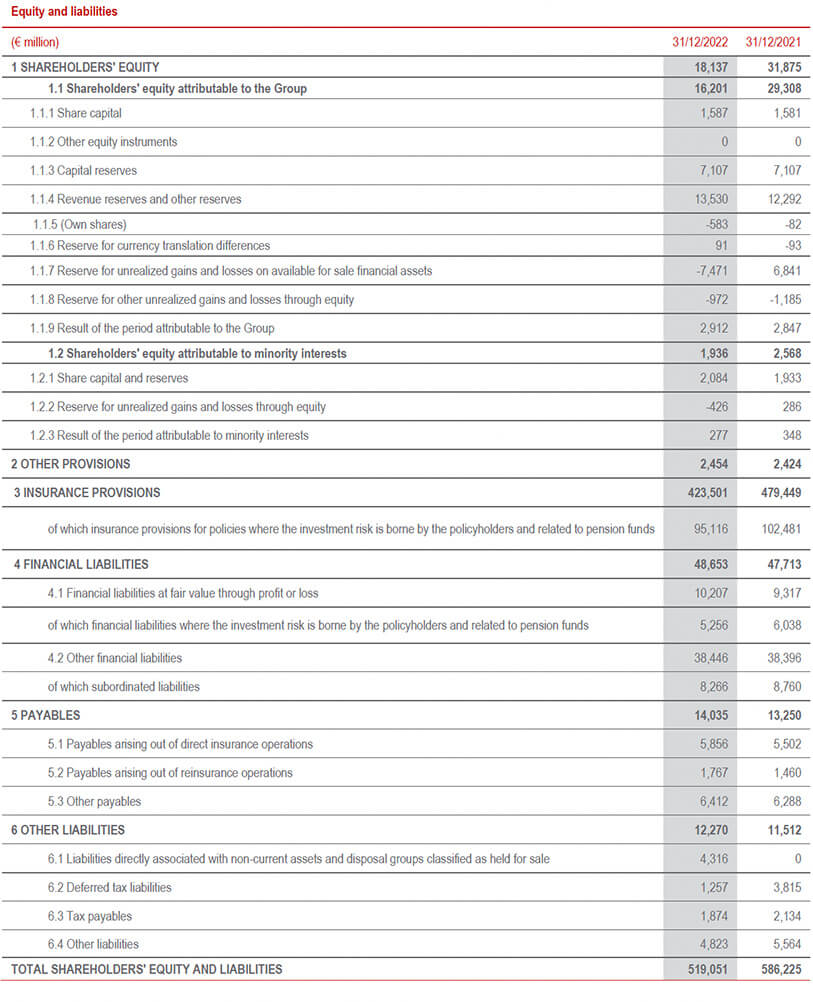

The Group’s shareholders' equity stood at € 16,201 million (-44.7%). The change was mainly due to the reduction in the available for sale reserves, following, in particular, the performance of bonds.

The Group confirmed an extremely solid capital position, with the Solvency Ratio at 221% (227% FY2021).

During the year, the Solvency Ratio has been supported by the strong contribution of the normalised capital generation and by positive economic variances, which have only partially offset the impacts of regulatory changes, M&A and capital movements (including the completed buyback and foreseeable dividend).

The normalised capital generation was confirmed at a solid level at € 4.1 billion (€ 3.8 billion FY2021).

Net Holding cash flows stood at € 2.9 billion (€ 2.6 billion FY2021), led primarily by higher recurring cash remittances.

Dividend per share

The dividend per share that will be proposed at the next Annual General Meeting is € 1.16 payable as from 24 May 2023. Shares will trade ex-dividend as from 22 May 2023, while shareholders will be entitled to receive the dividend on 23 May 2023.

The dividend per share marks an 8.4% increase compared to the dividend paid in 2021, reflecting strong earnings growth, the cash and capital position of the Group and the focus on shareholder returns.

The dividend proposal represents a total maximum pay-out of € 1,790 million.

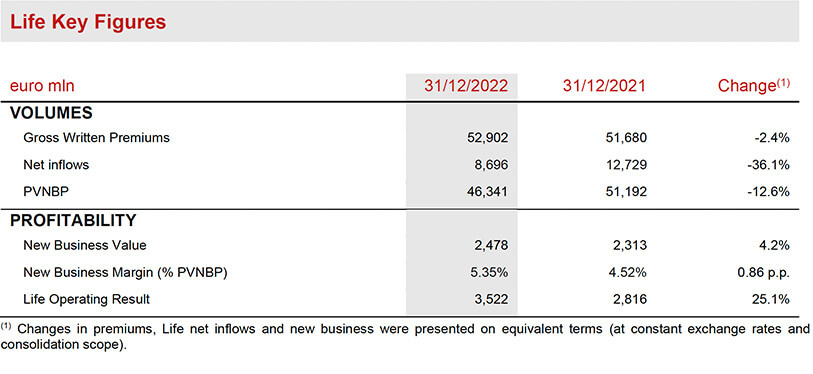

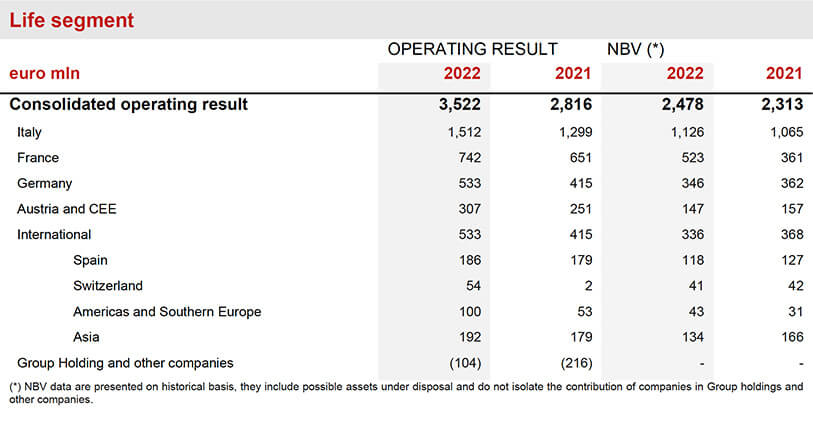

Life segment

- Strong increase in the operating result, reaching € 3,522 million (+25.1%)

- Excellent New Business Margin at 5.35% (+0.86 p.p.)

- New Business Value (NBV) rose to € 2,478 million (+4.2%)

The gross written premiums in the Life Segment6 reached € 52,902 million7 (-2.4%). The protection line increased (+3.8%), thanks to growth mainly in Italy, France and ACEE. The contraction in the unit-linked line (-3.3%) was attributable to the performance in Italy, which was partly offset by the positive performance in Germany, Spain and Asia. In line with the Group’s strategy to reposition its Life portfolio, the savings line contracted (-5.5%), due to a reduction in premiums in France, Germany and Italy.

Net Life inflows were resilient at € 8,696 million8 (-36.1%). The protection line inflows grew (+2.9%), demonstrating the Group’s ability to respond with innovative products to the growing demand of customers for protection solutions. The unit-linked inflows (-7.4%), reflected the greater uncertainty in the macroeconomic context and the very strong performance in 2021. The overall performance was mainly due to the savings line, consistent with the Group's strategy to reposition its Life business portfolio, as well as specific in-force management actions.

The new business production (expressed in terms of PVNBP - present value of new business premiums) was € 46,341 million (-12.6%), reflecting the uncertain macroeconomic context.

The New Business Margin on PVNBP further increased, reaching 5.35% (+0.86 p.p.), thanks to the significant increase in interest rates, the rebalancing of the production mix towards the more profitable unit-linked and protection lines, and the continued rollout of new products with improved protection features.

The New Business Value (NBV) grew to € 2,478 million (+4.2%).

The operating result grew strongly to reach € 3,522 million (+25.1%). The technical margin - net of insurance expenses - improved, thanks to the more profitable business mix. The net investment result also increased, primarily driven by recurring components, with both current income and reserving dynamics benefitting from rising interest rates.

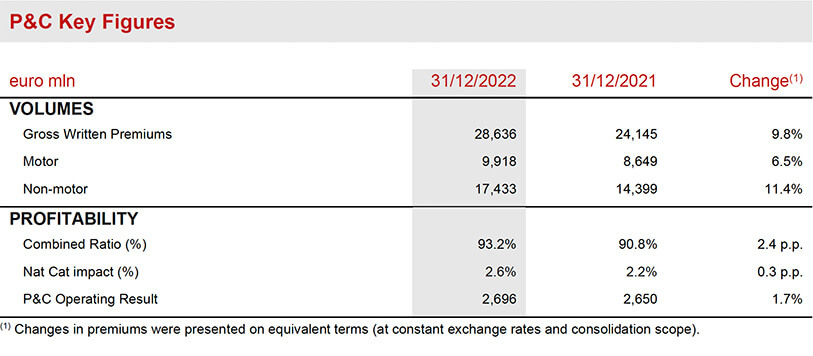

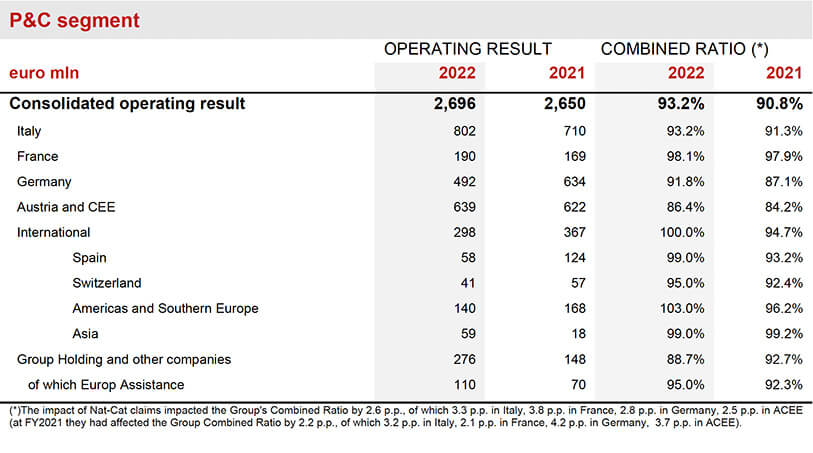

P&C segment

- Premiums strongly increased, totalling € 28,636 million (+9.8%)

- Combined Ratio was 93.2% (+2.4 p.p.)

- Operating result grew to € 2,696 million (+1.7%)

The gross written premiums in the P&C segment grew to € 28,636 million (+9.8%), thanks to the performance of both business lines.

The non-motor line grew by 11.4% across most markets in which the Group operates. The motor line increased by 6.5%, particularly in Argentina (mainly as a result of inflationary adjustments), ACEE and Spain. The premiums of Europ Assistance grew strongly (+73.0%), thanks to the contribution from new partnerships and the recovery in the travel business.

The Combined Ratio was 93.2% (+2.4 p.p.; 92.6% excluding Argentina), resulting mainly from the higher loss ratio (+2.0 p.p.).

The non-catastrophe current year loss ratio increased (+1.6 p.p.). On the one hand, it reflected the higher attritional9 current year loss ratio (+1.4 p.p.; +0.8 p.p. excluding Argentina, and the Cattolica group, India and Malaysia acquisitions) mainly due to the performance of the motor line. On the other hand, the non-catastrophe current year loss ratio also reflected higher large man-made claims (+0.2 p.p.).

The natural catastrophe loss ratio also increased (+0.3 p.p.). The contribution from prior year development was stable at -3.7%.

The expense ratio increased to 28.7% (+0.4 p.p.), due to an increase in administration costs (+0.3 p.p.) that reflected the consolidation of aforementioned acquisitions.

The operating result grew to reach € 2,696 million (+1.7%). The decrease in the technical result, reflecting the development of the Combined Ratio, was more than offset by the improvement in the investment result, which benefitted from increased current income.

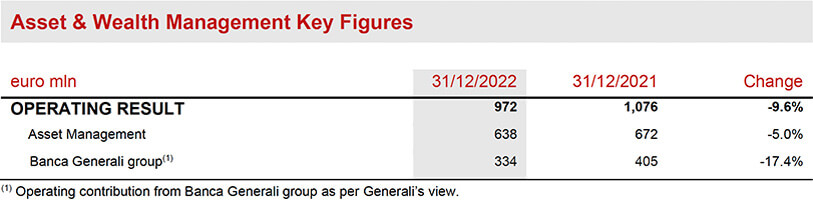

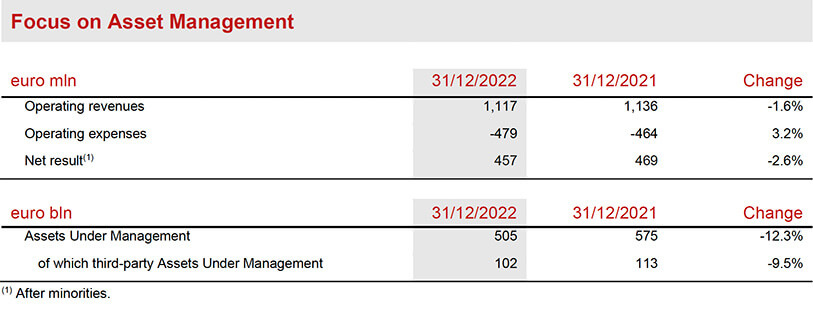

Asset & wealth management segment

- Asset & Wealth Management operating result was € 972 million (-9.6%)

- Asset Management operating result was € 638 million (-5.0%)

- Banca Generali group operating result was € 334 million (-17.4%) due to lower performance fees

The operating result of the Asset & Wealth Management segment was € 972 million (-9.6%).

In particular, the operating result of Asset Management activities was € 638 million (-5.0%), mainly due to the performance of financial markets during 2022, translating into a lower AUM base.

The operating result of the Banca Generali group was € 334 million (-17.4%); reflecting the performance of financial markets during 2022, which resulted in a reduction in performance fees, from € 221 million at FY2021 to € 19 million at FY2022. Banca Generali group’s total net inflows in 2022 stood at € 5.7 billion, confirming solidity in terms of volumes in a complex market environment.

The net result10 of the Asset Management segment was € 457 million (-2.6%).

The total value of the Assets Under Management managed by the Asset Management companies was

€ 504.7 billion (-12.3%). Third-party Assets Under Management managed by the Asset Management companies were € 102.1 billion (-9.5%). The overall reduction in assets was entirely due to the volatility of financial markets in 2022.

The net inflows from third-party customers grew by € 4.5 billion, despite the difficult market context.

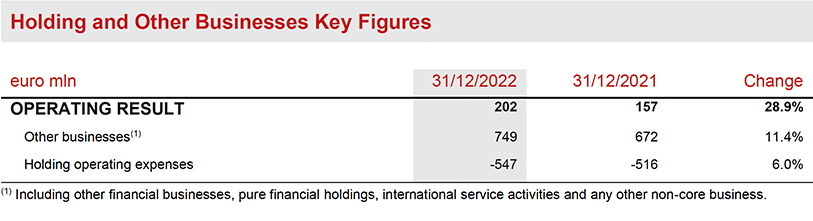

Holding and other business segment

- Operating result grew to € 202 million (€ 157 million FY2021)

- Positive contribution from the real estate business

The operating result of the Holding and other businesses segment reached € 202 million (€ 157 million FY2021)11.

The higher contribution from Other businesses was mainly thanks to the improvement in the real estate result, which also benefitted from some positive non-recurring effects in 2022.

Holding operating expenses increased by 6.0%, mainly due to the increase in costs related to personnel and the implementation of new strategic initiatives.

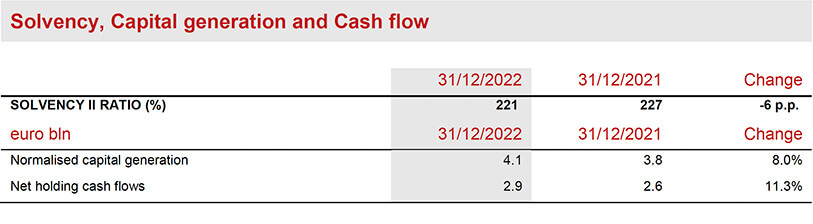

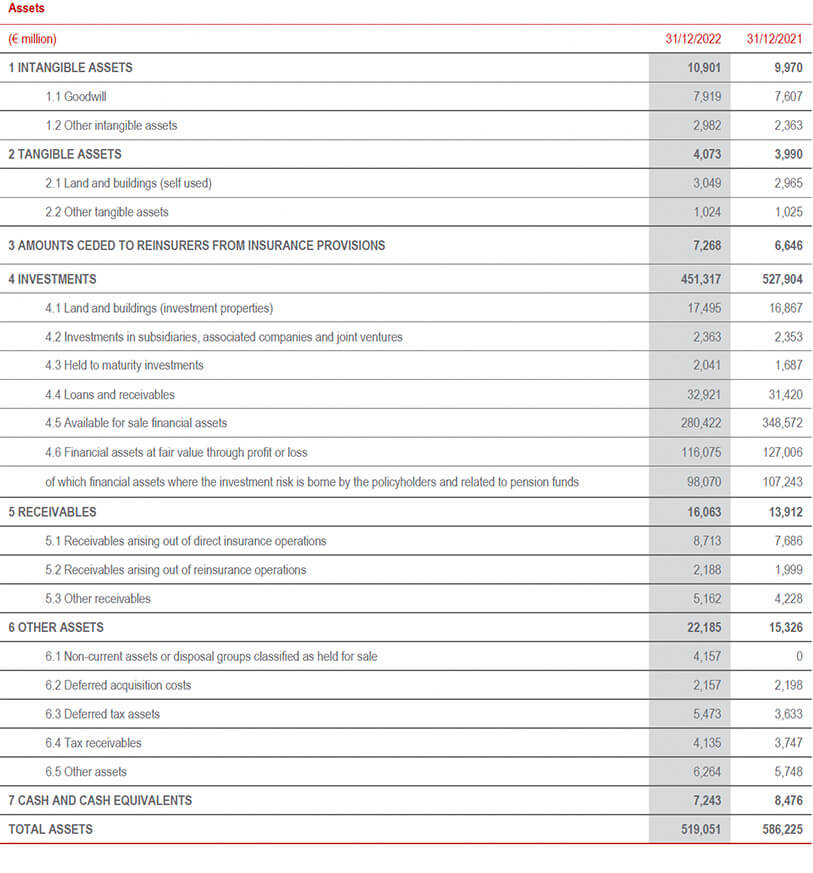

Balance sheet, cash and capital position

- Extremely solid capital position with the Solvency Ratio at 221% (227% FY2021)

- Capital generation stood at € 4.1 billion

- Net holding cash flows were € 2.9 billion

The Group maintained its extremely solid capital position, with the Solvency Ratio at 221% (227% FY2021).

The development of the Solvency Ratio throughout the year has been supported by the strong contribution of the normalised capital generation (+19 p.p.) and by economic variances (+7 p.p., primarily driven by higher interest rates). These effects partially offset the impact of regulatory changes (-5 p.p.), operating variances (-4 p.p.), M&A (-12 p.p.) and capital movements (-11 p.p., including the completed buyback and foreseeable dividend).

The normalised capital generation was very solid amounting to € 4.1 billion (€ 3.8 billion FY2021), mainly thanks to the further progress of new business in Life.

Net Holding cash flows stood at € 2.9 billion (€ 2.6 billion FY2021), led primarily by higher recurring cash remittances.

Outlook

In early 2023, some economic indicators, including European labour market data, seem to suggest mitigating signs against the possible slowdown of the global economy. Inflation readings and central bank comments at the beginning of 2023 have raised rates expectations by markets which remain uncertain. At the same time, it will be important to assess the impact from the fragility signs of some US banks that have emerged at the beginning of March. During the first half of 2023, core government yields may stay around the levels observed in the second half of 2022, before receding somewhat later in the year as inflation worries gradually subside. The implications of the macroeconomic situation described above could affect the global insurance sector.

In this context, the Group continues its strategy to rebalance the Life portfolio to further increase profitability and allocate capital more efficiently. It also maintains its focus on product simplification and innovation, with the introduction of a range of modular product solutions that are designed to meet the specific requirements of today’s customer, and are marketed through the most suitable and efficient distribution channels.

In the Property & Casualty segment, the Group's objective is to maximise profitable growth in its mature insurance markets, especially in the non-motor line, and to continue to strengthen its position in markets with high growth potential by expanding its presence and offering. Due to rising inflation in 2022 which mainly affected the motor line, the Group envisages additional rate adjustments, which will also address the impact of increased cost for reinsurance protections.

With regards to Asset Management, the Group will continue to roll out its strategy reported in the three-year plan. This includes extending the product catalogue and strengthening distribution capabilities for the Asset Management platform, with the aim to increase revenues and assets under management (AUM) from external customers. On the Wealth Management side, the Banca Generali group will continue to be focused on the delivery of its targets for size, profitability and shareholders’ remuneration defined in its strategic plan announced in 2022.

With these clear priorities identified and thanks to the results achieved in 2022, the Group confirms all targets of its “Lifetime Partner 24: Driving Growth” strategic plan, which is focussed on strong financial performance, best-in-class customer experience and an even greater social and environmental impact, delivered by all of Generali’s employees. The Group intends to pursue sustainable growth, enhance its earnings profile and lead innovation to achieve a compound annual growth rate for earnings per share12 between 6% and 8% in the period 2021-2024, to generate net holding cash flow13 exceeding € 8.5 billion in the period 2022-2024 and to distribute cumulative dividends to shareholders for an amount between € 5.2 billion and € 5.6 billion in the period 2022-2024, with a ratchet policy on dividend per share.

Generali's sustainability commitment

Sustainability is the originator of the “Lifetime Partner 24: Driving Growth" strategy, in which Generali has identified four responsible roles to play as an investor, insurer, employer and corporate citizen.

The 2022 achievements include:

- € 19.9 billion of premiums from insurance solutions with ESG components;

- € 3.2 billion of new green and sustainable investments;

- the successful placement of its third green bond, for a total value of € 500 million.

Furthermore, Generali is a founding member of the Net-Zero Insurance Alliance and is part of the Net-Zero Asset Owner Alliance. In 2022, it signed a strategic partnership with the United Nations Development Program (UNDP) to develop innovative insurance solutions. As a recognition of its accomplishments, in 2022 the Group confirmed its presence in the Dow Jones Sustainability World and Europe indices. In addition, Generali was upgraded by MSCI to their highest possible AAA ESG Rating, and was included in the MSCI ESG Leaders index.

Share capital increase resolution in implementation of the long term incentive plan 2020-2022

The Board of Directors also approved a capital increase of € 5,549,136 to implement the ‘Group Long Term Incentive Plan (LTIP) 2020-2022,’ having ascertained the occurrence of the conditions on which it was based. The execution of the resolution of the Board is subject to the authorisation of the related amendments to the articles of association by IVASS.

Proposal for long term incentive plan 2023-2025 and share plan for Generali Group employees

Furthermore, the Board of Directors resolved to submit to the approval of the Annual General Meeting the proposals related to the ‘Group Long Term Incentive Plan (LTIP) 2023-2025’ and the Share Plan for Generali Group employees, supported by buyback programmes for the purposes of the plans.

Resolution to cancel own shares without reducing the Share Capital as part of the implementation of the 2022-2024 Strategic Plan

The Board of Directors also approved the cancellation, without reducing the share capital, of 33,101,371 own shares, acquired for that end, implementing the resolutions by the Annual General Meeting of 29 April 2022. The execution of the resolution of the Board is subject to the authorisation of the related amendments to the articles of association by IVASS.

Significant events in 2023

Significant events that occurred following the end of the period are available in the 2022 Annual Integrated Report and Consolidated Financial Statements.

The report also contains the description of the alternative performance indicators and the glossary.

***

Q&A conference call

The Generali Group CEO, Philippe Donnet, the Group CFO, Cristiano Borean, and the General Manager, Marco Sesana, will host the Q&A session conference call for the financial results of Generali Group as of 31 December 2022, which will be held on 14 March 2023, at 12.00 pm CET.

To follow the conference call, in a listen only mode, please dial +39 02 802 09 27.

***

The Manager in charge of preparing the company’s financial reports, Cristiano Borean, declares, pursuant to paragraph 2, article 154 bis of the Consolidated Law on Finance, that the accounting information in this press release corresponds to the document results, books and accounting entries.

Generali Q42022 results

Further information by segment

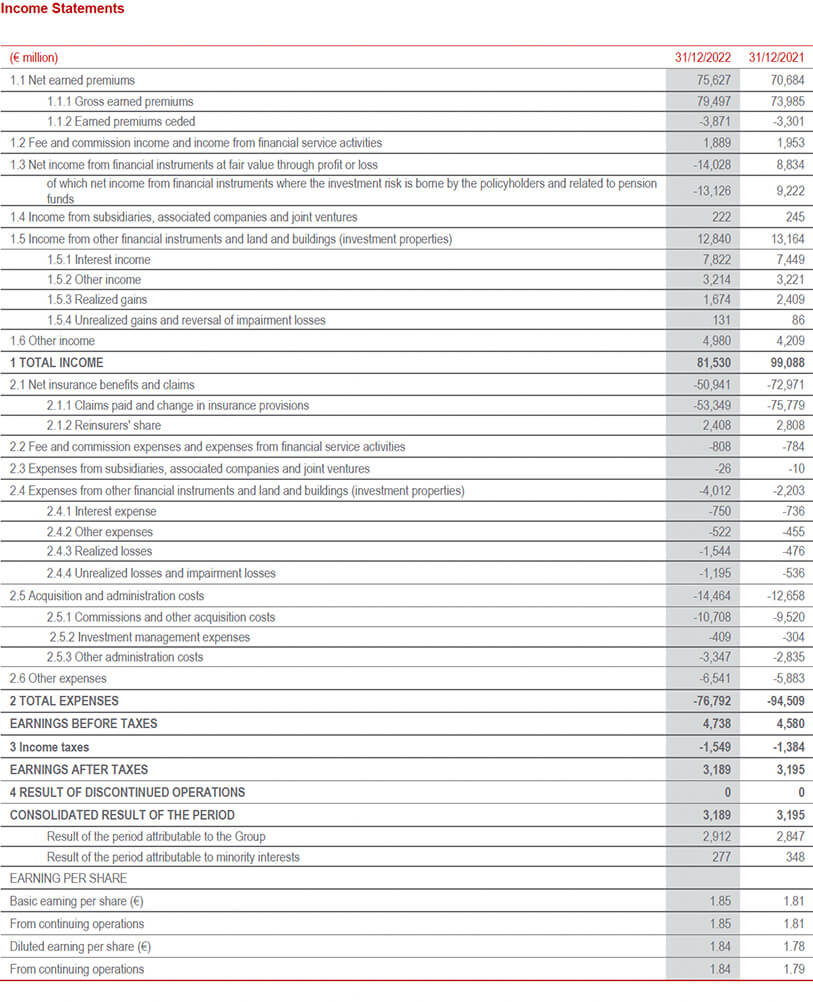

Group’s balance sheet and income statement (14)

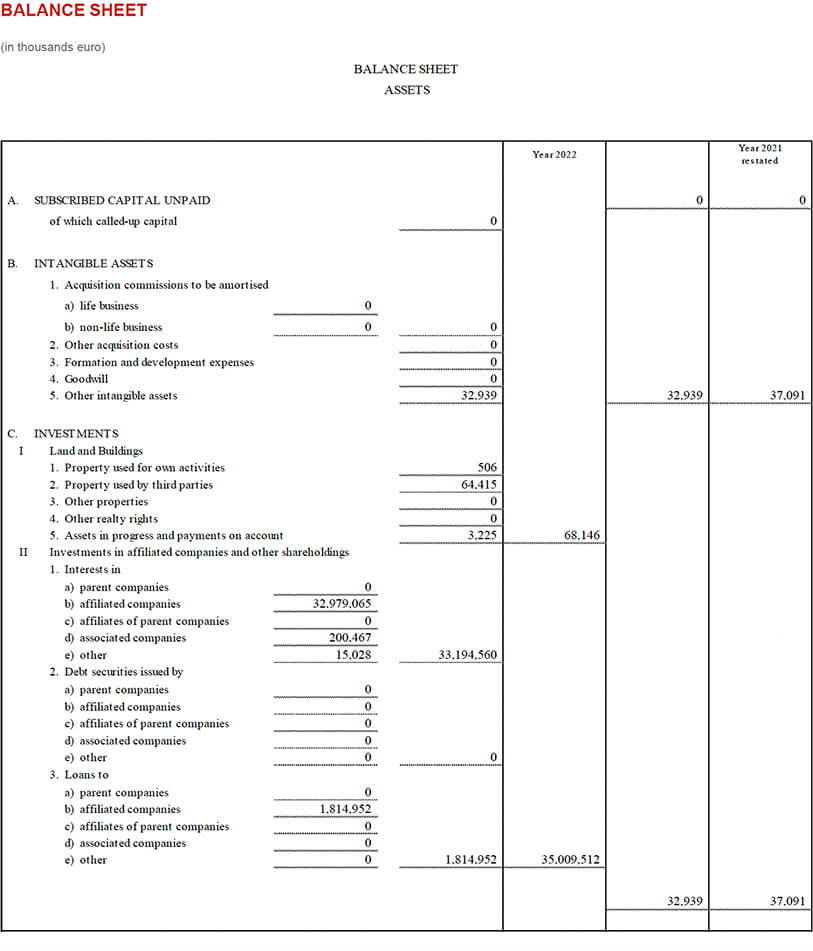

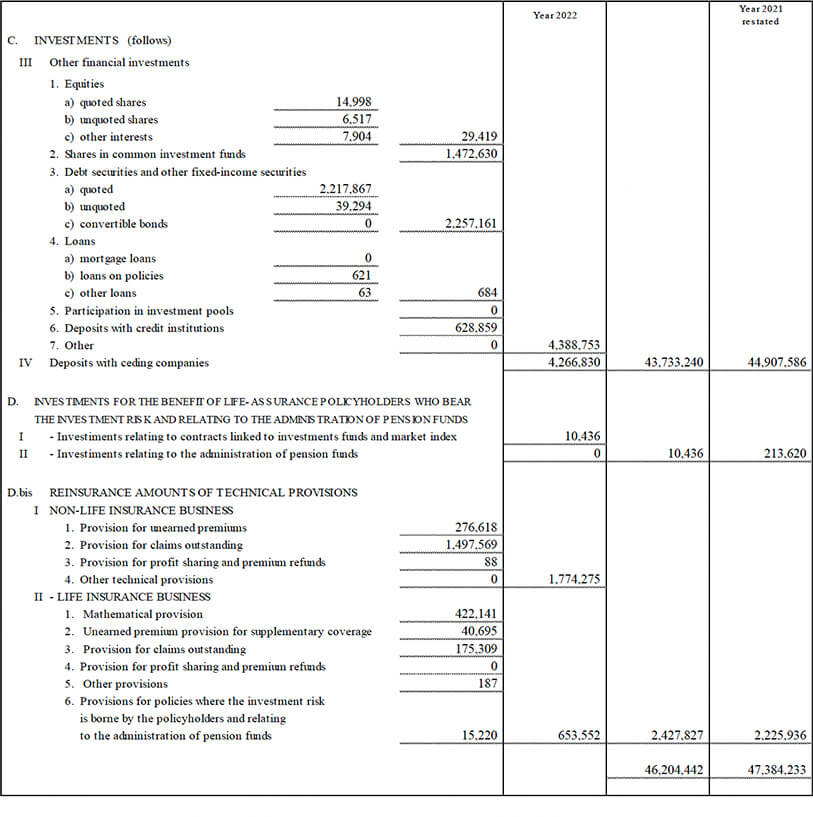

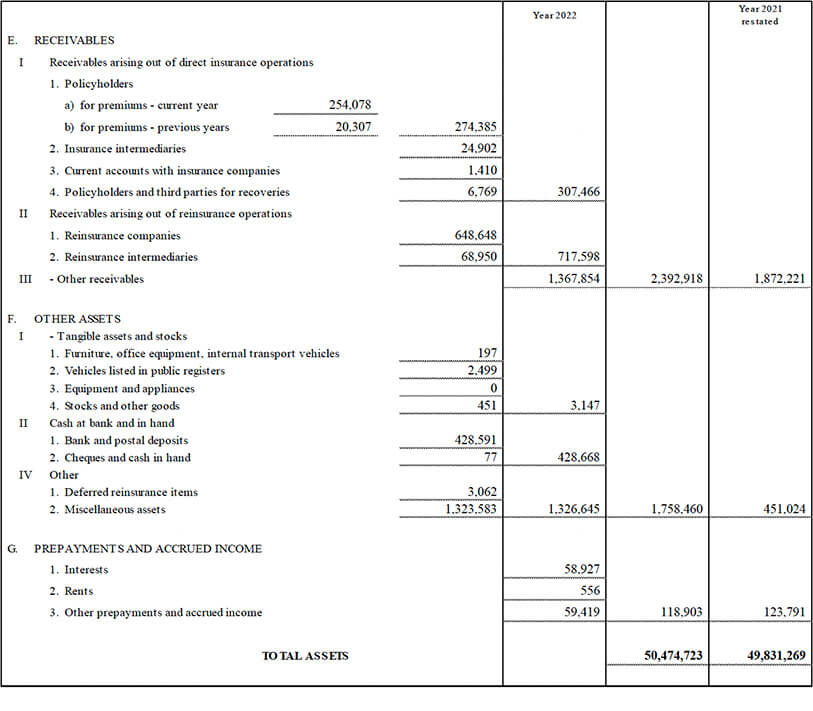

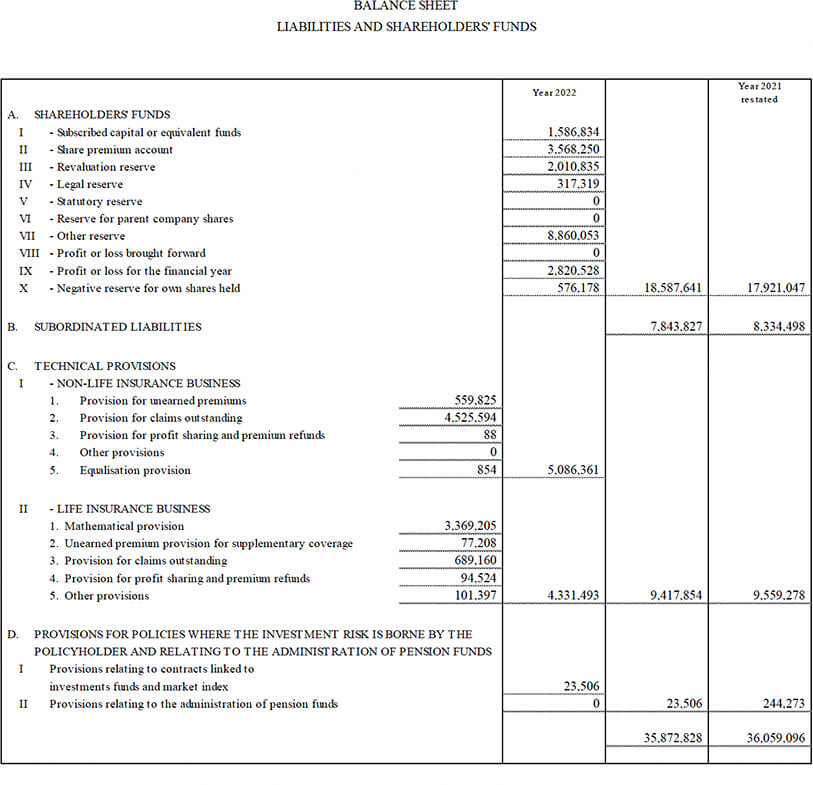

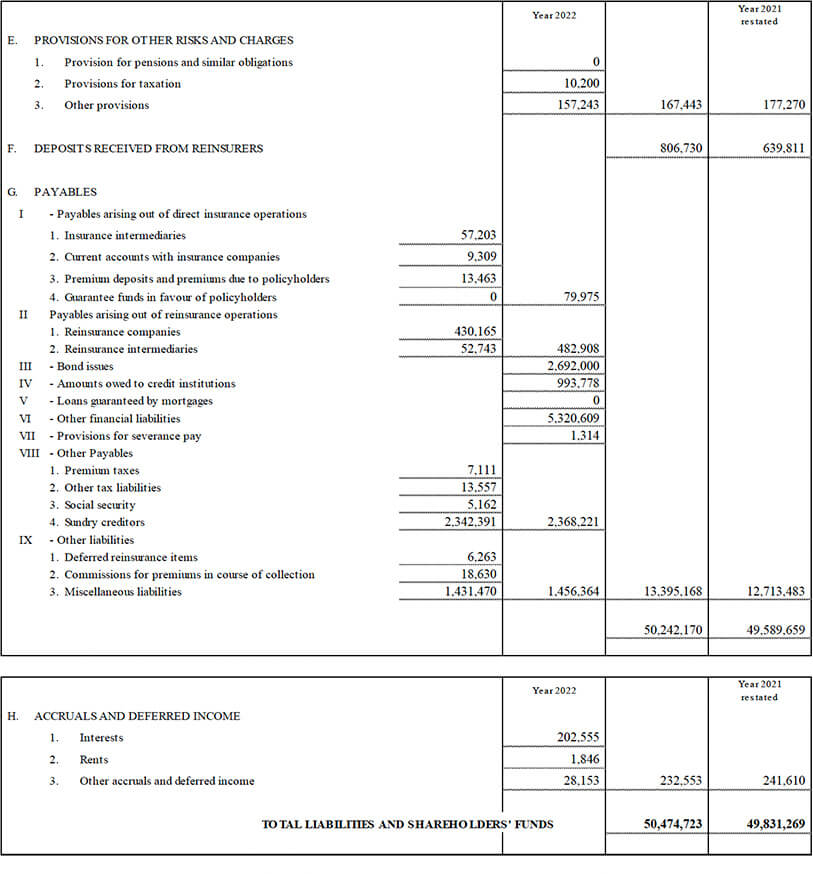

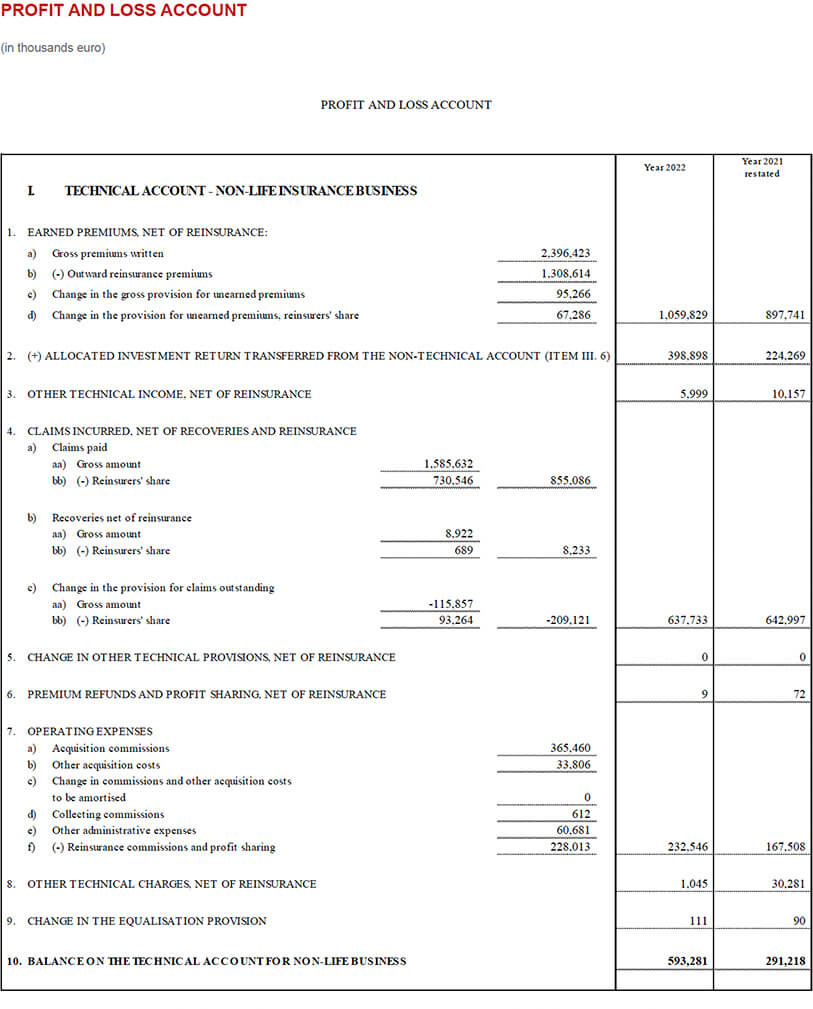

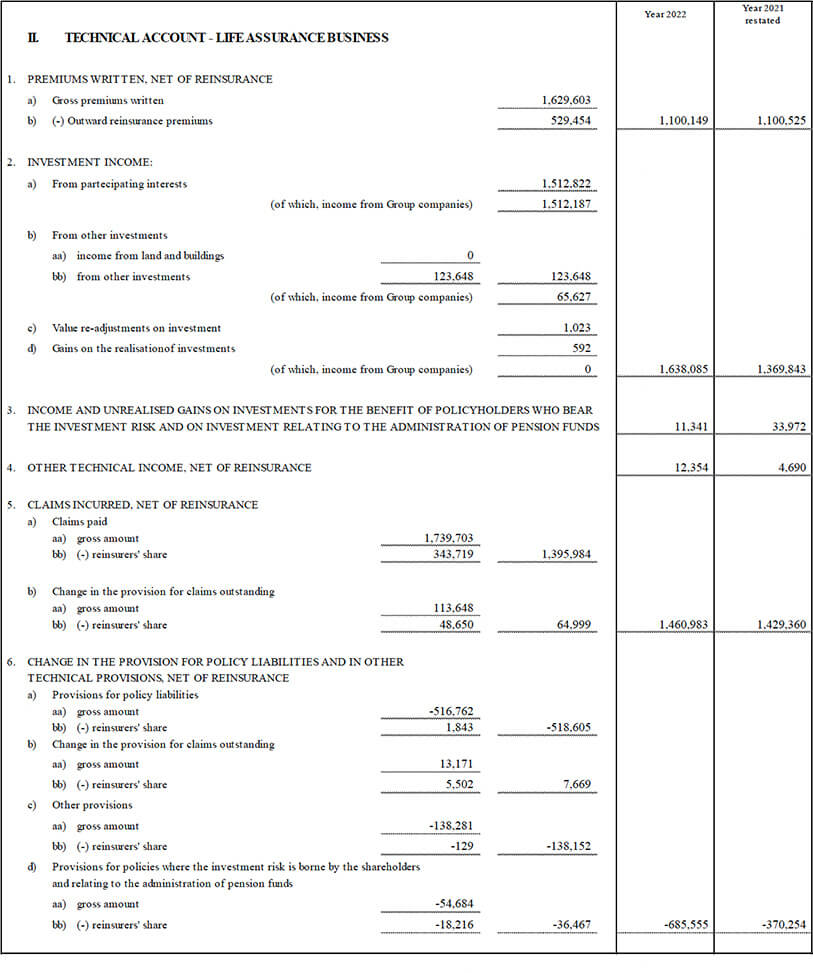

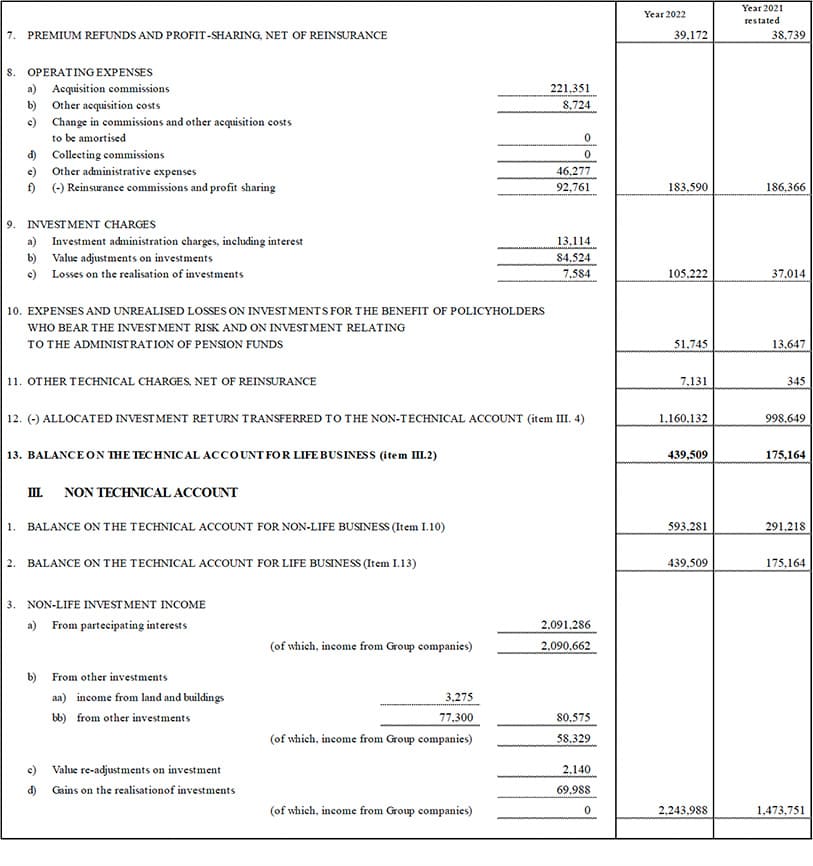

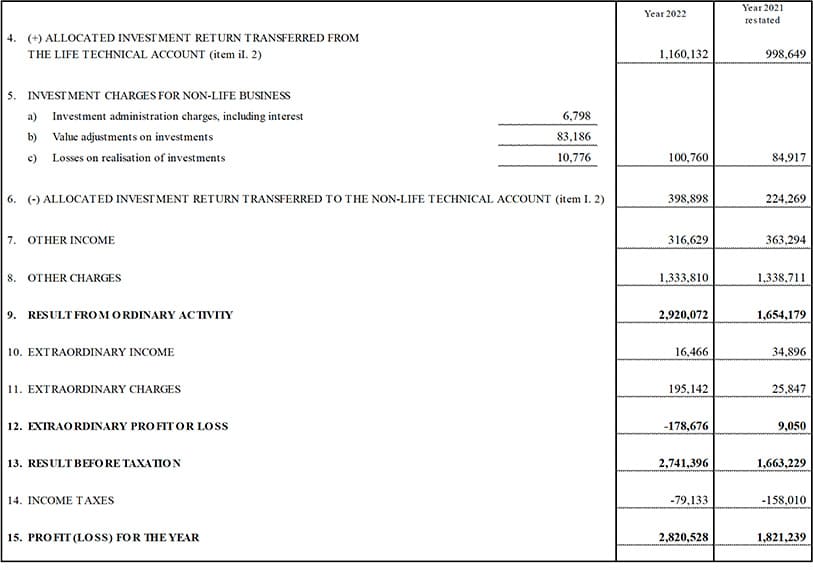

Parent company’s balance sheet and income statement (15)

1 Changes in premiums, Life net inflows and new business were presented on equivalent terms (at constant exchange rates and consolidation scope). Changes in the operating result, general account investments and Life technical provisions excluded any assets under disposal or disposed of during the same period of comparison.

The amounts were rounded at the first decimal point and the amounts may not add up to the rounded total in all cases. The percentage presented can be affected by the rounding.

2 The adjusted net result - defined as the net result without the impact of gains and losses from acquisitions and disposals – in 2022 was equal with the net result of the period, and is up by 4.2%. In 2021, it stood at € 2,795 million, calculated excluding € 52 million related to the acquisition of the Cattolica group and the extraordinary costs related to its integration.

3 Regarding the Group’s exposure in Russia, following impairments in FY2022, the stake in Ingosstrakh and fixed income instruments held directly by the Group, amounted to € 116 million (€ 384 million FY2021) and to € 18 million (€ 188 million FY2021), respectively. The Group also had Russian and Ukrainian indirect investments of € 14 million (€ 111 million FY2021) and unit-linked investments of € 19 million (€ 117 million FY2021).

4 The transactions for the Libeskind Tower in CityLife, Milan for € 67 million and the Saint Gobain Tower, Paris for € 80 million.

5 The impact deriving from Russian investments amounted to € 154 million, of which € 71 million refer to fixed-income instruments held directly by the Group and € 83 million to the investment in Ingosstrakh.

6 Including premiums from investment contracts equal to € 1,770 million (€ 1,518 million FY2021).

7 The contribution of the Cattolica group was € 2,493 million.

8 The contribution of the Cattolica group was € 400 million, almost entirely deriving from bancassurance agreements.

9 It is the component of the non-catastrophe current year loss ratio without the impact from man-made claims.

10 After minorities.

11 As from 1Q2022, this segment excludes the contribution from the Banca Generali group, which is included in the Asset & Wealth Management segment.

12 3 year CAGR; adjusted for impact of gains and losses related to acquisitions and disposals. Target based on current IFRS accounting standards.

13 Net holding cash flow and dividend expressed in cash view.

14 With regard to the financial statements envisaged by law, note that the statutory audit on the data has not been completed. The Group will publish the final version of the Annual Integrated Report and Consolidated Financial Statements 2022 in accordance with prevailing law, also including the Board of Statutory Auditors’ Report and Independent Auditor’s Reports.

15 With regard to the financial statements envisaged by law, note that the statutory audit on the data has not been completed. The Group will publish the final version of the Proposal of Management Report and Financial Statements of Parent Company 2022 in accordance with prevailing law.